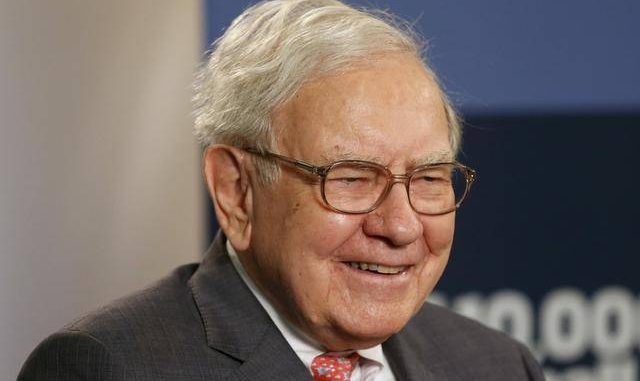

Warren Buffett was listed as the best fund manager of the 20th century by Inc Magazine. Initially, he started his career from Buffett Partnership in Omaha. He had managed funds of people located near to his house, later on with the abundance returns and publicity, he got great exposure.

If interested, you can read his full timeline here. However, in this blog post, I’ll teach you 9 lessons that I learned from the Great Investor: Warren Buffett.

The Tao of Warren Buffett is very useful book in my list of best investing books – lays down the strategies of Mr. Buffett in short and sarcastic language. Writings from the book are the primary source for this article.

#1) Diversification is the protection against ignorance. It makes very little sense for those who know what they’re doing.

If some investment advisers are trying to sell you on the idea of diversifying your stock portfolio, it is because they don’t know what they are doing when it comes to investments and they want to protect you from their ignorance.

The point is simple, instead of investing your funds in many mediocre companies, why don’t you invest it in selected outstanding companies. But to find that selected companies, you need to understand the industry and business economy of the stock.

But if you don’t know what you’re doing, diversification is a wise course in that it will offer you a protection against losing everything and maintain the potential of average growth over the long run. However, it is not going to make you rich.

Well said: Too much of good thing can be wonderful.

#2) I’m a better investor because I’m a businessman and a better businessman because I’m an investor.

A smart businessman knows a good and bad one – and a smart investor knows when a business is being sold cheap or is overpriced. So to be great in investing you need to behave like a businessman and when you got to buy a business, you need to be like the smart investor and know whether it is selling cheap or not.

Combine the 2 and you can make a billion. It’s that easy and it’s that hard.

Generally, people see the stock as a product which goes up and down on daily basis. They tend to get profit out of price fluctuation. Instead, they should see that stock as a marketable medium to buy a part of the business. Seeing market this way can help you make rational decisions.

#3) It is good to learn from the mistake but it is better to learn from other’s mistake.

Experience is the best teacher but it can expensive if you’re learning from your own mistakes. Spare some time to learn from the mistake of other successful investors.

You need to study not only what to do, but what not to do. Don’t only read success stories instead also space out your time for mistake stories.

I read Berkshire Hathaway annual letters by Warren Buffett where he grumbly accepted his mistakes in his whole. I would also suggest you to read them to dissect the mistakes of this century most successful investor – Warren Buffet.

#4) Wall Street is the only place where people ride to in a Rolls-Royce to get advice from those who take the subway.

#5) I look for businesses in which I think I can predict what they’re going to look like in 10 to 15 years.

Take Coca-Cola. I don’t think the internet is going to change how people drink Coca-Cola. A consistent product equals to consistent earnings. If the product doesn’t have to change, you can reap all the benefits of not having to spend money on research and development, nor do you have to fall victim to the ups and downs of fashion.

Buying a stock at competitive cheap rates and then do you think that what will these company is probably be selling in 15 years? If you can then you might just be the next Warren Buffett.

In the stock market crash of 1974-74, you could buy Ogilvy & Mather, on of the then strongest advertising company in the world for $4 a share against EPS of $0.76, which equates to 5 PE ratio. Warren bought tons of it during the crash and cashed out many years later after excellent annual returns. Some investments are just that simple.

#6) You should look at stocks as small pieces of a business, not as a trading product.

Sometimes people invest, they forget that they are actually buying a fractional interest in a business. Look at stocks as you’re owning a small fraction of a business. This way you can judge whether you’re paying too much for the business.

A simple way to evaluate a business is to just get a rough figure of the whole enterprise value at a certain period of time and compare it with the product of outstanding shares and current market price. This way you can figure out the proper valuation and price of the business.

Think of it this way, Would you buy the whole business at current valuation? IF yes, then buying even a single share is acceptable and if not, then its single is also expensive.

#7) Anything can’t go forever will end.

A stock price which is quickly rising will stop rising when the economic reality of the business finally sets in. Most businesses that are doing well now may fade away at some point in future. Things change – video player, typewriter were in huge demand in past but now it has no economic promise. All the related business vanished.

Things do end, which is why, you not only need to keep your eye on the ball, but also on the road ahead. In simple words, Invest in the business that never come to end.

#8) If a business does well the stock eventually follows.

A simple market phenomenon that Warren relies on is that if the underlying business does well over a long period of time, the stock price will increase to reflect the underlying increase in the value of the company. This also happens in the opposite case.

The long term period of the company has a way to rectify the situation, no matter which direction. Market punish bad stocks and rewards good stock in the long run. However, in the short run, market is like voting machine.

Thus the internet stocks that hiked very high in the bull market seems to drop down like a rock when they fail to make money in long run. If you buy a stock that has beaten down, you had better make sure that the long-term economics of the business are still good.

#9) Happiness doesn’t buy happiness.

You can be the richest person in the world but without the love of friends and family, you would be poorest. Warren when asked to define success, he always says in a fluent manner, It is being loved by the people you hope to love you.

The truth is that extensively large amounts of money can actually create a great deal of misery in your life. Money to some extent, sometimes let you be in more interesting environments. But it can’t change how many people love you or how healthy you are.

Note: These are only the 9 lessons out of total 125 lessons that I found interesting from the book The Tao of Warren Buffett.