I get it.

I understand how brutal it can be — trying to beat the market in a world of big investors with multi-million rupees investing budgets.

You have a limited funds, limited time, limited knowledge, and a limited arsenal of tactics that you can afford to implement.

But the big players? They can do anything they want, hire as many people as they want, and unleash any tactic they want. They have many analysts impulsing their day and night digging market trends.

Today’s small retail investors are forced to compete in an increasingly saturated marketplace.

The competition is fierce, and it has become incredibly difficult to rise above the noise.

Combine this with the massive disparity between a small retail investors and a much larger enterprise’s infinite resources, and it’s obvious that the cards are stacked against small investors.

In fact, finding excellent stocks is one of the top concerns of small retail investors, and many claims this is the biggest issue they face.

How can small investors attract the needle in their favor and go head to lead the market trends?

Here comes the 3 Step Process that I had implemented and immensely succeeded the market.

I personally call it Market Scrapping Technique. As being a small investor, you’ll also find it interesting and profitable in live market.

When done correctly, these strategies can help any small investor compete with the big players in market (MF, Hedge funds managers, financial institute managing a band of analysts or any high profile brokers).

It’s part of the glory of Stock Market Investing. Anyone can compete. Anyone can succeed.

Even the little guy with no prior judgement.

You just have to know how. And believe me, it’s not that hard. You can beat the big players in market with your limited resources.

Great Investor Peter Lynch had firmly accepted the advantage of small individual investors over large institutes.

You can get a good understanding of his Investment philosophies in his books: One Up On Wall Street and Beating The Street.

Same mentality is explained by Late Investor Parag Parikh in his book: Value Investing & Behavioral Finance.

Institutional Investors are bound to their superiors, quarter by quarter. If they fail to show positive results quarterly, they lose their reputation. But investing works well in long run. That is why many institute fails to fulfill their goal despite having an educated analysts.

Market Scrapping Technique

It is a 3 Step Process which explain the scrapping process of stocks from market based on parameters you understand.

The central idea is to create a basket of stock which you understand and never let your money get outside the basket.

Here goes the 3 Step Process:

- Build a Basket of stocks based on your understanding.

- Set Alerts to stay up-to-date with your corpus.

- Push and Pull your Money in the basket.

Let’s dive in.

Step #1: Build the Basket

Basket is a group of objects of similar characteristics. Here, in our niche, I’m talking about the basket (group) of stocks which you understand.

BUT.

Why there is a need to create the stock basket?

BECAUSE.

It will help you to reduce your work time. Being a Small Individual Investor – it’s obvious – you may be stuck in your 9-5 work schedule.

You’ve everything limited.

Look. Analyzing a stock is a long run process. It’s not like – you randomly picked a stock – piled up the historic performance – looked over the numeric stats – BINGO! you found the gold.

It can take days, weeks and even months to properly understand stocks or industries.

However, you can reduce this time by creating a basket of limited stocks.

An ideal number of stocks in a basket is 30. No, I don’t mean to invest instead keep a track of all. Further, keep switching your funds from one stock to another based on the situation. (More on it in Step 3).

But building a basket of 30 stock is not an easy task.

No doubt. Initially, you would need some time, research, number crunching to create a perfect personalized basket of stock.

But once it’s build, everything will go seamlessly.

How to create a Stock Basket?

Based on your understanding you need to create a basket.

If you’re an Engineer, you can create a basket of IT related Stocks.

If you’re a Doctor, you can create a basket of Pharma Stocks.

If you’ve a finance background, you can create a basket of Financial Stocks.

If you’re an experience in XYZ sector then you can create a basket of XYZ related stocks.

If you’ve a good understanding of 2 or more niche then create a Hybrid Basket.

Remember, sector investing works well if did appropriately. First, you know the industry. Second, you have a limited number of targets. Third, you know the risk associated with the industry.

You can find stocks filtered by sector by just doing a simple Google Search – Your Sector Stocks India. Replace the Your Sector with the sector that make you dance.

Click the first link of Moneycontrol. Here, you can find almost every stock filtered by sector.

Next, start analyzing stocks based on historic performance. You can use Moneycontrol, Screener or any other website to carry on your historic number crunching process.

Alternatively, you can also filter stocks by historic performance instead of sector selection.

For this purpose, Screener is the perfect tool. Open the Query Builder, copy-paste the following queries and “Run This Query”.

Return on capital employed > 18 AND

Average return on equity 5 Years > 16 AND

Price to Earning < 16 AND

PEG Ratio < 1.8 AND

Up from 52 week low < 20 AND

Dividend Payout Ratio > 15

Above parameters are just for illustrative purpose. You can add/remove stats as per your understanding.

This will present you with bunch of stocks for which you can create a basket.

And don’t forget to review your basket. Time to time, keep adding and removing stocks from the basket. This process works well after you follow the Step 2.

Once you did this then you don’t need to again and again waste your already occupied time to analyse fresh stocks from scratch.

What you need to do further is – just stay updated with the recent actions and news of company in the basket, which is explained further in next step of Market Scrapping Technique.

Step #2: Set Alerts

I found that many of you follows the same traditional procedure of picking stocks – which is explained in Step 1.

As stated above, analyzing a stock is not a short term process. It takes days, weeks and even months to get a proper understanding of the company’s operation.

So just relying on historic performance is not enough.

After creating the basket of stocks, you need to analyse the trend of the company. This is the crucial step to find the diamonds in your basket.

Not all the stocks in your basket will be top performer. This is the story of every top performing portfolio: Only few outperform the market and boost up the Overall Portfolio Returns.

Same will happen with you if you properly followed the steps mentioned in Market Scrapping Technique.

And this 2nd step will help you to increase the chance to get more of top performing stocks in your basket.

How?

Setup many alerting tools available on internet to get notified whenever something new aired related to any stock. I’ll show you the exact process to get yourself digitally viable for free.

I had personally used many tools but I found only 2 of them beneficial and effective (and free):

Former is the best tools to stay up-to-date with anything. You can set alerts of your favorite football team, new movie release etc.

In our case, you can set alerts for any stock. Google have a good indexing infrastructure which track all the newly published webpages related to your alerting keyword.

You can easily setup alerts from the Google Search page. Search any stock like “SBI stock market” and navigate to the news section. Scroll down and click “Create Alert”.

You can also personalized (time, priority etc) your alerts. It’s that simple.

Now just stay cool and keep a hold of your email inbox. Don’t get lazy to read articles related to your companies and stocks. That’s how you can stay updated with your chosen instruments in the basket.

Second, Valuepickr is a forum where many experienced investors discuss their opinions on different stocks.

Here’s the link: forum.valuepickr.com. Have a visit and sign up. Search for your stock in the search bar.

First, read the full threads of the companies that you have in your basket. Next, subscribe to the related thread to get notified whenever somebody post their opinion in the thread.

That’s it. Follow the same procedure for all other stocks in your basket. For further digging, a simple search on Google will swamp you with more than enough results.

Small Summary: Step One will assist you to create basket of stocks and Step Two will assist you to understand the stocks in your basket. Step Three (next and last step) will assist you to manage funds in your basket.

Step #3: Push and Pull

Pushing means adding funds in your portfolio and pulling goes opposite.

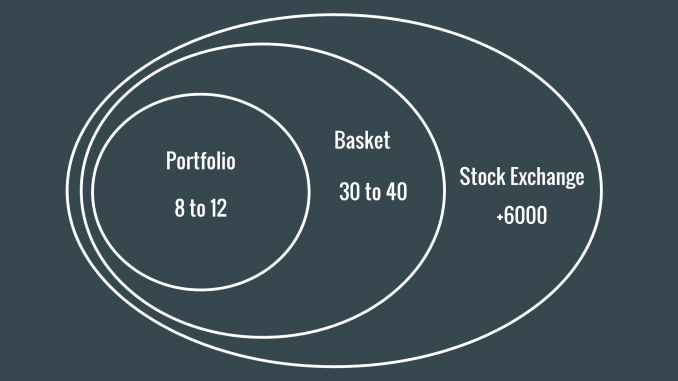

Earlier stated, 30 is the ideal number of stocks you should have in your basket but that doesn’t mean, you need to invest in all of them.

Basket’s stocks are the maximum number of stock you understand and are interested to track. Finally, invest in the stock which you think will outperform other stocks in basket.

Being a Small Individual Investor, my suggestion would be to keep 8 to 12 stocks in your portfolio, all selected from the basket you created earlier.

Next, you need to lock you money in that range of stocks. Don’t try to get out of basket’s stocks. In other words, stay in your circle of competence.

Here’s how you can manage your funds in your basket and take your portfolio to next level:

First of all, push all your funds in the selected range of stocks (i.e. 8 to 12). Next, stay updated with all the stocks in your basket and accordingly, push/pull money from stocks in your Portfolio.

Let’s say, a renowned company found guilt in any corporal scam. And that stock forms the part of your portfolio. Here is where the corpus you laid down in Step 2 will come in action.

Google will start springing you with prioritized news links. Discussion will evoke in the Valuepickr community.

Properly, read all the available content and shape your decision of whether you want to stay invested or square off your holdings.

If the outcomes are short term adversities – like the one happened with AMEX in previous century – then stay invested or add more funds at dips.

If the adversities looks like affecting the long term operation of the company then get out of it. Welspun India can be perfectly quoted in this preview.

Listen. Their are many conditions, situations, factors which actively works to make a sound investment decision. More you have an understanding of the company, industry, economy, peers etc – more better you can make the investment decision.

Well quoted by Warren Buffett:

So instead of watching your portfolio P&L every hour, read news, articles, presentations or whatever you can find related to the stock in your basket. Google Alerts and Valuepickr will surely provide you with more than enough results.

Read. Read. Read.

Accordingly replace/add/remove stocks from/in the basket and eventually in your Portfolio.

If you take few minutes to again go through above two steps you may figure it out that the whole process works on 2 tier filter model:

Step 1 takes you through the past performance of the company and Step 2 assisted you to create a intact corpus to stay updated with current updates which eventually helps you to estimate a rough future performance.

Stocks are first filtered on past results which forms the basket and then they are again churned for future trends which forms your portfolio.

Your job is to keep a track of their past and future performance so that you can push & pull money whenever you see a change in these 2 timed performance.

Remember, investments take time to grow in values. It’s not possible to produce a baby in 1 month by getting 9 women pregnant. Patience is the key to success.

Now You Try It

I hope you can see the potential of The Market Scrapping Technique for your small investments.

Yes, it takes hard work to create something great.

But with this strategy you already know ahead of time that your hard work is going to pay off (unlike pumping out bunch of stocks hoping for some will turn multibagger).

Ready to get started?