I’ve been tracking this stock since last several days and astonished by its high fall since last 20 trading sessions, chances are it may further fall more.

In this article, I’m going to highlight following points:

- Glimpse of its price drop

- What’s the reason behind such a high drop?

- Is the drop justified?

- Is it the perfect time to enter the stock?

Glimpse Of Its Price Drop

Company stock is falling at a great pace since 17 June. Even its price charts are quite horrible. Don’t believe me, just watch.

Here’s the drift point on 17 June’16: (3 months chart)

Here comes the Slide drop: (1-month chart)

Here comes the staircase drop: (5 days chart)

Here comes the last day circuit drop: (1-day chart)

These symmetric designs are due to all day price drop at the lower circuit. There are 3 phases of lower circuit (rough calculation):

- 20% (for initial 2-3 lower circuits)

- 10% (for later 2-3 lower circuits)

- 5% (for long lower circuits, might be more than 8 consecutive days)

Now its doesn’t need Einstein mind to figure out that the company is at its 3rd phase.

All the web is just full of news about this company. Here’s the peek from Google News:

- Mandhana Industries, Vimal Oil among 17 scrips that hit 52-week low during intraday

- Mandhana Industries shares fall 77% in last 20 sessions

- Mandhana Industries locked lower circuit for 18 straight trading sessions

- Mandhana Industries hits six-year low

- Mandhana Industries shares hit lower circuit for 8th day in a row

- Mandhana Industries hits record low

- Mandhana Ind dives 49% in 5 sessions on spin-off decision

- Mandhana Industries, SRS among 9 scrips that hit 52-week low during intraday

All that I got on the web from different news channels. And the internet will keep flooding for “Mandhana Ind” for next several days. Now, you might be curious to know the reason behind such a high drop. Okay, lets, switch to next section.

What’s The Reason Behind Such A High Drop?

People are highly bearish towards this stock but if you look 3 months back then even you might be dying to buy this stock. Even many high professional analysts were bullish on this company like the one below:

Words by Analyst: Ashish Kapur, CEO, Invest Shoppe India

Mandhana Industries: Mandhana Industries is a major player into textile space and in spite of a pretty bad time that textile industry has seen in the last couple of years this company has done extremely well.

“In FY14, their profit was Rs 59 crore which jumped to almost Rs 83 crore in FY15. This year, I am expecting profit to be Rs 100 crore plus,” said the analyst. One more trigger which is in sight is they are demerging their retail venture — Mandhana Retail retail venture — Mandhana Retail Venture — from the existing setup and every shareholder of Mandhana Industries.

“So in the next three months, once this value unlocking takes place, I am expecting Mandhana Retail Ventures will float at not less than Rs 500 crore market cap,” he said.

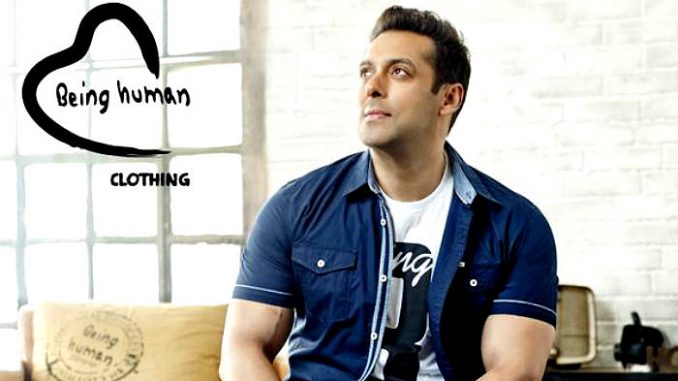

“The speculation on Mandhana Industries’ reported differences with Bollywood actor Salman Khan’s charitable trust over the profit sharing terms for selling his branded clothing line has seen shares tumble 60 per cent last week.

The stock was locked at its lowest circuit for at Rs 123 on the BSE.The reason behind the difference is believed to be Khan’s demand for equal profit sharing or royalty, whichever was higher from Mandhana’s sale of Being Human branded products.

Mandhana has a tie-up with Salman Khan Foundation for selling Being Human branded clothing line, for which 5 per cent royalty was paid to the trust. Being Human contributed around 10 per cent to the company’s sales in 2014-15. Mandhana was in the process of signing a new contract with the charitable trust. It will however be demerging its retail business to Mandhana Retail Ventures“

Being Human’s retail business grew by 96 per cent to Rs 172 crores. The margins from earnings before interest, depreciation, tax and amortization through Being Human stood at 27 percent compared to 12 percent of Mandhana’s remaining businesses. Seeing high growth and profit, Mandhana promoters decided to demerge the retail business to unlock value. This prompted the actor’s trust to ask for a higher royalty and share of profits. Hence, rumors about a difference, which has already sent many investors into a tizzy.

As per source alphadesire, “The company currently shares 5% royalty to the Foundation & receives the right to sell apparels under the brand Being Human. Being Human sales contribute only 10% of the total sales of Mandhana Industries. Mandhana’s retail business grew by 96% during the recent fiscal year. The Being Human brand just contributes 10% of the total revenues of the company. It is advisable to gain exposure once the sell-off cools to encash the opportunity.”

So the tiff between this 2 entity leads to the high drop. Mandhana Ind was also affected in many alternate ways. Initially, the company only have around 15% of pledged shares but after the price drop, it turned to 46%.

Many big player investors also loaded off large amount of stocks in market:

IFCI, ECL Finance and Kotak Mahindra International Ltd A/C Premier Investment sold 5 lakh, 15.53 lakh and 2.34 lakh shares, respectively, of the company via a block deal, according to NSE data. The total 24.87 lakh shares were offloaded by these three investors for Rs.17.50 crore.

Still, the buyer side is not disclosed. Just curious to know the buyer.

Also, rating agency CARE recently downgraded the company’s non-convertible debentures to BBB+ from A which also added an uncertainty risk for their debt entity.

However, the company is going to demerge its business into the retail branch. The shareholders of Mandhana Industries will get 2 (two) equity shares of the retail branch (MRVL) to every shareholder holding 3 (three) equity shares of the company.

The company also said that Mandhana Retail Ventures is in the process of signing a new contract with Salman Khan’s Being Human Foundation; the specifics of the contract are under negotiation with them.

Is the drop justified?

The drop is justified but not to such high extent. The company had received a nod by BSE long ago but still it has not any action which creates a sense of uncertainty among investors and then somewhere in mid-July, a news about the tiff between being human and mandhana popped out, which create a bearish trend on this stock. Now every stockholder wants their stock to get sold off in the market due to very less buyer as compared to the seller, the stock keeps hitting the lower circuit.

But in my opinion, such a high drop is not justified.

As Being Human only contribute 10% of the sales so it might not affect the company’s operation at great extent. 90% of sales are still with them. However, Salman Khan brand added a great EBIDTA margin of as high as 25 percent and contributed 10-15 per cent of the consolidated sales. The EBITDA margin of the remaining business was only 14 per cent.

Is It The Perfect Time To Enter The Stock?

The real reason for the price drop is the uncertainty over being human brand profit sharing. So if it becomes certain then it’s a great buy at its current rock-bottom price.

I also found something interesting: Job offers by Mandhana Ind. This shows that company is in the process for its retail business and will soon come up with the announcement. The job offer was posted 10 days back and Ahh! one was from my place: Hyderabad.

Want to get employed? Apply here 😀 😉

I can’t predict the perfect time to invest but I can bet that even a slight positive news will drift the share up at upper circuit. However, everything is unclear till its disclosure of financial statements, somewhere in mid-August.

However, I’ll consider it buying whenever the trend of “ending on lower circuit” faded away.

Updated: After a long streak of Lower circuit, the company finally locked at the upper circuit on Monday with only buyer.

Disclaimer: I’m thinking to buy some shares but currently, I don’t own any share in this company. In addition, I also don’t own your money, so any loss incurred due to my opinion is the responsibility of yours. I just shared my opinion.