What if I say this single piece of content is enough to optimise your stock portfolio for awesome results?

Yeah! I’m not lying.

I can’t accurately predict the prices of stock in the short term. You should find a technical analyst to do so.

However, long-term stock prices are the great followers of fundamental statistics of a stock.

Well said by Benjamin Graham:

Stock market is voting machine in short term and weighting machine long run.

Now, I assume that you only bought 4 stocks named A, B, C & D.

A & B are under-performing stocks whereas C & D are over-performing stocks.

Firstly, let’s analyse under-performing.

Now suppose you got a chance to personally meet Warren Buffett and ask him whatever questions you’ve.

You asked him to value all 4 stock (A, B, C & D).

His valued and his remarks are as follows:

A – Awesome!

B – Bad.

C – Excellent.

D – It stinks.

So what should be your individual actions with stocks with respective remarks? Lets find it out:

STOCK – A

It is under-performing but as per Mr. Buffett remarks, it’s an awesome stock. So it will outperform the market in long run.

But it’s under-performing now, so what should you do now?

Aggressively Invest more funds in this stock because Mr. Market gave you another chance to buy that stock for the more undervalued price. To understand it more clearly, you should know the term MOS.

Do you know the concept of Margin of Safety (MOS)?

You do if you’ve read Intelligent Investors (Chapter-20) by Benjamin Graham.

MOS basically states that it’s good to buy a 100 million company for 80 million but it’s better to buy it for 50 million.

Why?

Because it will reduce the average cost of buying the company which in turn will reduce the risk associated with losing money.

In terms of Warren Buffet – “Something good happens to my mind if I buy a buy a dollar bill for 50 cents”

Side Note – Mr. Market is a term coined by Benjamin Graham in his book Intelligent Investors which denotes aggregate market behavior.

Action Plan: You should buy more of A as market provide you that stock for more bargain price.

STOCK – B

As per Buffett analysis, it’s a bad investment.

So quickly square-off your position. Sold it out.

Chances are (but not sure) that it may hike in coming days, weeks or even month but in long run, Mr. Market will punish the stock.

There is a great saying – “Stop digging if you find yourself in a hole”

I confronted the same position when I bought Treehouse. I bought it at 76 and the stock tumbled to 65.

So what I should do?

Should I wait until the stock recover the losses?

Of course, Not. I found myself in a hole so I stop digging. I sold it out and booked the losses.

Now its quoted at half rate:

In November’15, It went to 450 and just one single year it’s less than one-tenth

It’s all due to lack of corporate-governance transparency and even promoters holdings were at low of 20% that too 100% pledged. Receivable is at high of 626 million at the time of recoverable.

Big investors (like the one below) sniffed the position and offloaded quickly which resulted in huge price downturn.

So quickly sell out the under-performing stocks if it is not fundamentally strong, chances are it will reduce to more and even more.

Mandhana Industry also hit by the same downturn due to lumpy fundamentals and locked at the lower circuit for more than 20 consecutive trading period and lose its value by more than 80%.

Action Plan: Sell it out. No excuse, just sell it.

STOCK – C

There’s not much to understand about it.

It’s an excellent stock and also over-performing so no need to change the positions. However, if you want to buy more of it, go on.

Here a single piece of advice I would like to share with you is:

So don’t end up selling shortly.

STOCK – D

It’s a bad investment and over-performing.

Wow! Mr, Market gave you a chance to sell this stinky stock for prices higher than it deserves.

Quickly offload it.

Remember the words by Benjamin Graham, “Market is weighing machine in long run”

So if the stock is a bad Investment and is over-performing it’s due to the voting mechanism of market participants in the short run. The market will absolutely punish the stock in the long run.

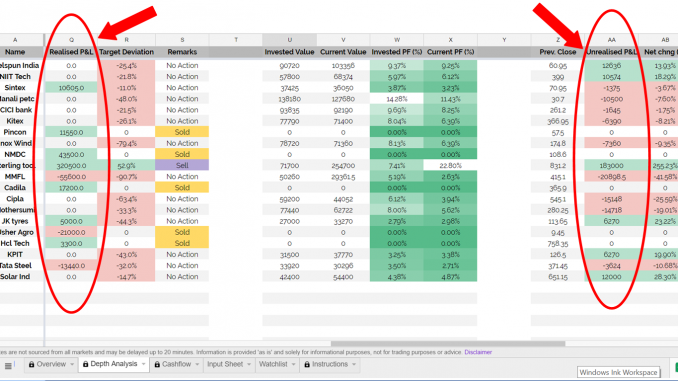

Once, I bought a stinky stock named Usher Agro:

I bought this at roughly 4% profit when I found it a bad investment

First mistake I did is to buy it on seasonal factor (monsoon).

The stock performed well for weeks and then lost it values by half. However, I sold quickly sold it when market mispriced the stock as overvalued.

This stock is having a high Debt element and low-interest coverage ratio.

Here’s a lesson for you:

No matter how successful investor you become but you can’t become perfect. Even The world’s greatest investor Warren Buffett sometimes make mistakes (Hint: a single retina scan of Berkshire Hathaway annual letters will swamp you with more than enough mistakes he did in his whole career).

But the real success is where you learned from mistakes. It’s not always that you need to do mistakes to learn from it instead learn from other. Well said:

SO based on above facts and figures, optimized your portfolio stocks to get maximum possible returns.

Conclusion: Analyse stocks and figure out the intrinsic value. After finding the intrinsic value sold out stinky stocks and buy more of great stocks in a manner mentioned above.

Now what you need is an intellectual mind to analyse stock like other Successful Value Investors do, in order to find good & bad stocks and that’s where the most of the investors falter.